November 1, 2010

This article is based on information gethered from presentations given at this year's SAE OBD II Symposium. Recent and pending regulatory changes, as well as safety initiatives, in the automobile industry affecting light duty (LD) and heavy duty (HD) vehicles are creating turbulence for tool manufacturers, especially scan tool makers. In addition, exponential growth in vehicle complexity, increasing interdependency between systems, a shift in underlying on-board diagnostics (OBD) architecture and security/safety concerns, coupled with demand from users for more intuitive ease-of-use and the inclusion of service paths with diagnostics, are putting manufacturers between a rock and a hard place. These forces will bring challenges to some and opportunities to others. Have you got the game to survive in these changing times? User experience matters Imagine yourself standing third in line at a Starbucks shop waiting to order a cup of plain black coffee. When asked by the counter serviceperson, Customer One says,” I’d like an iced quad venti non-fat dark cherry mocha.” Customer Two then orders, “I’ll have an extra-shot, large raspberry large skim mocha on ice.” Does this make you question whether you – as Customer Three – even knows how to order your drink? Now, let me ask you a seemingly simple diagnostics question: Can you tell me the exact difference between those two drinks? Ask a few of your colleagues, and don’t let them write it down. Diagnostics, even in the coffee world, is exact, I presume. Moreover, it’s a world of service on the fly.

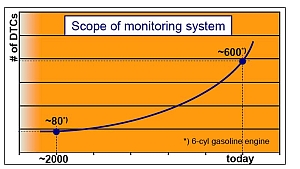

For the record, the two drinks ordered above are identical, other than one single difference — the flavor. The worst that can happen should the coffee technician complete a work order incorrectly is that, other than a short wait, the customer gets an apology and a replacement at no cost. At a price of about $4, most consumers are unconcerned. But what if, like in the automotive world, that upfront price was $100, or $1,000, or even worse, unknown? Comebacks then take on a whole new meaning. Compared to the coffee world, the automotive diagnostics world, its terminology and its technology are just as industry-specific and mystifying, but the stakes and risk for the customer are ratcheted up. Fear, control, apprehension, lack of understanding, trust level and other concerns gain a foothold inside a customer’s psyche, often before even purchasing your tool. The answers lie in how you proactive you are and how you respond to user concerns: They can be a hurdle or an opportunity to build relationships and a client for life for those who grasp it. Now, consider what plays out when a “Check Engine” light comes on: When a tech hooks up a scan tool, the diagnostic trouble codes (DTCs) are displayed. Of course, we all know it doesn’t end there. A DTC is not a diagnosis. The on board diagnostic (OBD) system has, however, detected a fault. More diagnosis is almost always required, often with additional diagnostic tools such as a smoke tester, borescope or multimeter, before any parts can be replaced. To do otherwise is to play parts roulette and make comebacks a regular occurrence. With today’s telematics connectivity (e.g. OnStar, Sync, mbrace, AutoLinQ), what if instead of the “Check Engine” light, a more descriptive and appropriate message popped up on an in-car screen such as “Your vehicle may have an emissions fault. Your EVAP system circuit has a problem. It’s safe to continue driving your vehicle for a short period, but your car’s fuel economy, emissions and performance will suffer. You should schedule a service appointment as soon as possible.” Wouldn’t this make for a more connected motorist-customer?

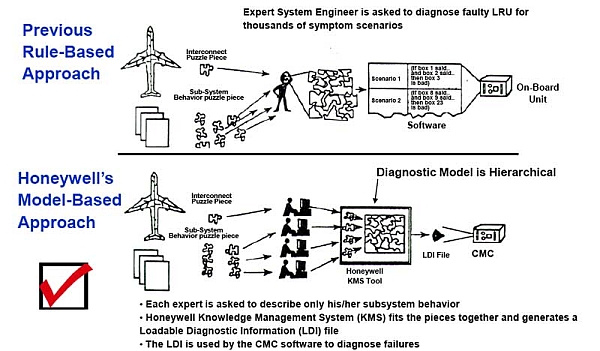

Pie in the sky? Airplanes have much more complex OBD, prognostic and redundant systems, much of it designed to prevent a catastrophic fall to earth, says Tim Felke, Engineering Fellow in Honeywell’s Condition-Based Maintenance Group. The high regard for safety in addition to the higher investment in an airplane relative to an automobile makes the premium for safety and diagnostics more affordable. Yet technology does transfer to automobiles over time. Boeing 777s have three multipurpose control display units (CDUs) located on the flight deck that provide data display and entry capabilities to the pilot for flight management functions. These units are the primary interface with the integrated Airplane Information Management System (AIMS). Developed in 1991, AIMS replaces the former system of multiple black boxes and eliminates much of the wiring harness communication on aircrafts. It organizes everything together in one rack that the OBD modules plug into. This enables higher speed communications between the modules and allows system partitioning to be optimized around functional blocks, such as power supply modules and processor modules. In addition, aerospace conditions-based maintenance OBD architecture employs two supervisory systems. The Crew Alerting System provides safety-critical indications of loss of function to the flight crew. The Maintenance System provides nonsafety critical assistance to ground personnel for fault isolation and repair. Line Replaceable Unit (LRU) modules detect fault conditions and loss of functionality. “LRUs are responsible for fault containment and recovery,” explains Felke. “Flight deck checklists have been created for fault conditions that require action by the crew,” He adds that all crew actions are entered into a log book. “When something goes awry on a Boeing 777, a schematic of the affected safety system pops on a display in the cockpit,” says Jack Hendrickson, senior trainer for American Airlines Training and Conference Center in Dallas-Fort Worth. “The location of where the problem is highlighted on the schematic. The pilot can then touch the screen and get detailed instructions from the AIMS to address and correct the problem in-flight. If necessary, the pilot can make arrangements for an emergency landing, if necessary, at the nearest airfield, normally no more than 160 miles away during a flight.” While there is typically a time lag before aerospace OBD systems migrate to vehicles, as well as a watering down of functionality based on need vs. cost, it is unlikely that a pop-up system schematic and OBD remedy system will show up in vehicles. But given recent safety problems associated with vehicle electronics and the political attention being paid to them, the potential for more sophisticated OBD safety-related scan tool functionality appearing in cars is there. For instance, imagine if automotive scan tools diagnosis worked more like a 777’s. Reining in Diesel California Air Resource Board (CARB) emission regulations for HD and LD diesel were formally approved in May 2010, for implementation in 2013. The next planned review is in 2012. For the most part, changes were made to harmonize HD with LD diesel OBD II regulations, which are newer. “Diesel engines can be a significant low-emission, high-efficiency powertrain option,” says Joe Kubsch, executive director of the Manufacturers of Emission Controls Association. “But achieving near-zero exhaust emissions poses significant future OBD challenges that will drive technological innovation.” As diesel engines begin to be monitored to the same strict levels as gasoline engines, there will be more and more need for scan tools to diagnose them. Diesel scan tools will become increasingly more complicated to design from a software standpoint. These two factors will motivate established LD scan tool manufacturers to enter the field and cause HD scan tool manufacturers to improve their game. However some changes regarding HD were made:

Harmony is a moving target “The worldwide OBD regulatory efforts are not harmonizing in all areas of HD diesel regulation,” notes Jim Nebergall, a technical advisor with Cummins Inc. “Monitoring requirements are converging in some areas, while standardization requirements are significantly diverging.” For example, the United States uses continual malfunction indicator lamp (MIL) behavior as criteria, while Europe uses discriminatory MIL behavior. Another is the U.S. broader focus on particulate matter, oxides of nitrogen (NOx), hydrocarbons and carbon monoxide; Europe is only focused on the first two. From a HD certification standpoint, the United States allows self-certification, while Europe requires witnessed certification. The gaps that remain impose different requirements on scan tool manufacturers feature sets for different jurisdictions. “Having common requirements reduces complexity, lowers costs and increases quality and reliability, with little value to the environment or end-user,” Nebergall adds. Challenges that need to be overcome include developing a common OBD system that can meet the different sets of requirements and harnessing increased scan tool development costs. Shifting architecture Relatively slow data transfer speeds and bandwidth limitations are prompting initiatives to move network communications from controller area network (CAN)-based to other architecture, such as Flexray, Media Orientated Systems Transfer and ultimately, Ethernet.

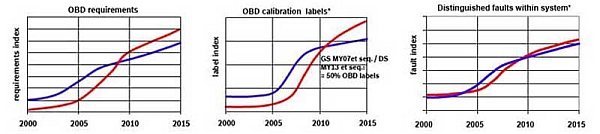

Another example of architectural change heading downstream is Fault Symptom Exchange Description (FXD), a new standardized diagnostic exchange format, agreed to by Volkswagen, Audi, Mercedes-Benz, BMW, Porsche, Continental and Bosch. “The evolving complexity of OBD monitoring systems and regulation has increased the number of DTCs dramatically,” explains Matthias Stampfer, a spokesperson for Continental AG. In this joint venture, the automakers defined the requirement, while Continental and Bosch developed the FXD format, Stampfer adds. The format can accommodate more disparate sources of diagnostic information (photos, documents, table, mixes) that was driving the generation of consistent and common documentation between OEMs and suppliers and regulators. FXD is currently being piloted, with the first diagnostic scan tool to be released in late 2010. Another architectural concern is security. Carmakers and suppliers are adding smartphone connectivity to vehicles. Examples include General Motor’s OnStar, Ford’s Sync, and Daimler’s mbrace and Continental’s AutolinQ. “For the first time, engines can now be started and doors locked by ordinary consumers, from anywhere on the planet with a cell signal,” states Dave Kleidermacher, chief technology officer at Green Hills Software, which builds operating system software that goes into vehicles and other embedded systems. “Manufacturers need to design the systems with security in mind from the very beginning,” Kleidermacher adds. “You can not retrofit high-level security to a system that wasn't designed for it. People are building this sophisticated software into cars and not designing security in it from the ground up, and that's a recipe for disaster.” He notes that there have already been several instances of hacking into electronic systems, including ones with OBD. The extension of OBD to monitor and address nonemissions malfunctions to monitor faults is clearly a trend that scan toolmakers have to address. Examples include airbags, antilock brake system (ABS), electronic stability program (ESP), active safety systems and app-delivered telematics. In addition, making tools backward-compatible isn’t always done or possible without driving costs beyond an economic threshold. It is clear that OBD isn't going away; it’s just going to get more complex and demanding of scan tool manufacturers. So consider one more trend. Just a few years ago, smartphones and apps didn’t exist. What if scan tools a few years hence are smartphones or tablets? Would that rock your world? ### |

Full Members of ETI:

Registration is now open for Winter Tech Week.

When: December 6-9, 2010

Where: Tokyo, Japan

Click here for more info and registration.

You can now purchase copies of ETI's Market Research Survey Reports on Flash Reprogramming, TPMS and Telematics. Click Here for more information.

| Regular Features

Feature Stories

Other Links

|

Copyright © 2010 - All Rights Reserved

Industry Update - is produced by the Equipment and Tool Institute, Inc.

Statements of fact

and/or opinions expressed are the responsibility of the authors alone and do not imply an

opinion of their officers, directors or members of ETI. Segments in their entirety may be

reproduced provided ETI Industry Update is credited as the source.

Equipment & Tool Institute

134 W. University Dr.

Suite 205

Rochester, MI 48307

PHONE 248-656-5080

FAX 603-971-2375

By Bob Chabot, Contributing Editor

By Bob Chabot, Contributing Editor