Contributed by Bob Chabot Contributed by Bob Chabot

ToolTech 2011

pinpoints future business opportunities

for ETI members

ToolTech Week 2011 — one of the Equipment

and Tool Institute’s (ETI) three annual core

events — focused on “Exploring the Shop of

the Future.” Like the individual threads

that makeup a tapestry, the nine

presentations made during the week provided

attendees with a stunning portrait of the

future — an insightful look not only at

where aftermarket service and repair

facilities are headed, but also what key

emerging trends will drive opportunity for

tool and equipment providers to the

aftermarket.

Nine presentations were shared by ETI’s

distinguished panel of speakers, each of

which is now available for viewing in full

at the ETI

website. These included:

- The Role of Society of Automotive

Engineers Service Support Policy Center

(Shuvo Bahattacharjee, Bosch ETAS Policy

Adviser).

- The SAE-OEM-ETI Initiative

(Bernie Carr, Bosch Diagnostics Senior

Product Development Manager).

- Global Diagnostics and Support

Services (Mark Saxonberg, Toyota Motor

Sales USA Service Technology Manager).

- Findings of the 2011 ETI Collision

Repair Research Project (Tim Morgan,

Elektron Inc. Managing Director, and Bob

Holland, Chief Automotive Technologies

Key Accounts Manager).

- Future Automotive Technologies — A

Tier 1 Supplier Perspective (Dave Hobbs,

Delphi Corp. Senior Trainer).

- Road map to the Future — A National

Provider’s Perspective (Bob Armstrong,

Bridgestone Retail Operations LLC

Automotive Equipment & Supplies

Manager).

- Realities of Fleet Service for Today

and Tomorrow (Mike Hasinec, Penske Truck

Leasing Vice President of Operations, ,

and Tom Kotenko, Snap-on Business

Solutions General Manager).

- Technologies and Standards Enabling

the Automotive Aftermarket (Nick

Cosimano, Carma Systems Inc. CEO, and

Chip Keen, Garage Operator Inc.

President).

- The Role of OEM Scan Tools in the

Aftermarket Shop of the Future (John

Jenkins, C.A.S. of New England CEO).

Takeaways you

can bank on

Change can be our friend, provided it’s

faced, prepared for and managed. “New

technology has permeated most aspects of our

businesses,” notes Mike Cable, outgoing ETI

President. “By staying on the cutting-edge

of new technologies and being vigilant about

pursuing the OEMs for information, ETI has

been able to bring our members the latest

data, insights and market research at events

like ToolTech.”

“It’s one thing to identify and resolve OE

information gaps for the aftermarket —

that’s the short-term fix,” added Charlie

Gorman, ETI Executive Manager. “But the more

thought that goes into the aftermarket

issues during the design, manufacture and

serviceability determinations of a vehicle,

then the less gaps there will be to begin

with. That’s the long-term fix that will

benefit everyone, from automaker to

technician to customer, be it brand

experience, service/repair competency of

business profitability.”

ToolTech’s presenters explained how this

could be done. While viewing the above

presentations online is informative, it is

the competitive edge provided by being

present in the discussion of the

presentations during question and answer

periods, the many networking events and the

trade show showcase that crystallizes

meaningful insights and “ah-ha” moments into

business opportunities. That’s why everyone

should consider going to ToolTech Week next

year, which will be held from April 17 - 19,

2012 in Palm Springs, Calif.

Each of the presenters delivered a

consistent message: The automotive

aftermarket “Shop of the Future” is bright,

provided the entire industry continues to

capitalize on improved communication,

cooperation and collaboration. For those who

were unable to attend ToolTech Week this

year, here are five key insights that can

truly impact your business.

Insight #1: An empowered automotive

aftermarket benefits everyone

Improving the working relationship between

the OEMs and end-user professionals who use

information and tooling to fix vehicles is

essential. For years, light-duty vehicle

OEMs have been required by the Clean Air Act

and the National Automotive Service Task

Force (NASTF) agreement to provide their

service information and factory scan tools

to the aftermarket for a reasonable price.

“In the past, OEMs seemed to ignore the

aftermarket because they do not think this

segment is important to their future — a

faulty business strategy then presumed their

customer brand experience ended when the

warranty expired,” explained Gorman. But

that has changed. “OEMs now realize that the

aftermarket is clearly an untapped gold mine

that could be very profitable to those OEMs

willing to pursue it through aftermarket

partnerships and cooperation.”

Consequently, aftermarket serviceability of

vehicles is now considered by OEMs

throughout a vehicle’s life cycle, beginning

with design and extending throughout

development, manufacturing and other

processes. Not only are costs reduced, OEMs

have discovered that the overall improvement

in brand experience translates to higher

customer retention when the next vehicle

purchase decision is at hand.

Bernie Carr (Bosch Diagnostics) echoed this

reality. “Improving vehicle serviceability

means both sides, OEMs and the aftermarket,

need to collaborate meaningfully. As tool

and equipment makers, we need to build stuff

that technicians want to use. For at the end

of the day, it is the aftermarket’s

technicians and service advisers who

customers identify as the real interface

when it comes to service/repair.”

Insight #2:

Open standards will tame rampaging

vehicle complexity

Trying to rein-in the vehicle electronic

revolution and burgeoning technological

complexity is like herding cats: Trying to

do it individually consumes too much time,

energy and cost. But collaborating to agree

upon and employ common open standards and

architecture offers a pathway for

streamlining the exchange of raw OEM data

into a common format that diagnostic scan

tool manufacturers can use to provide

improved, easier-to-use products to

service/repair professionals.

“Collaboration can benefit OEMs, Tier 1

suppliers and the independent aftermarket in

a number of ways,” stated Shuvo

Bahattacharjee (Bosch ETAS), standardizing a

format for data exchange between OEMs and

tool manufacturers could help simplify

vehicle diagnoses, enable key OEM

intellectual property to be protected,

improve the exchange of vehicle failure data

over longer cycles, foster the development

of new methods for prognostics and

predictive diagnostics and reduce

legislative-driven requirements. Each of

these would vastly improve the experiences

for technicians in the aftermarket as well

as customers experience.”

Improved communication and common open

standards could help reduce diagnostic

tester development costs, agreed Mr. Carr.

“There's lots of parametric data, in many

various forms, across many vehicle makes and

models, that requires a high effort to

effectively manage. Administering this data

creates a huge cost challenge for

businesses.”

It’s not just a one-way street. Mr. Carr

shared that aftermarket toolmakers also want

to partner with OEMs to standardize how tool

data streams and algorithms are

communicated. For the aftermarket, this

means lower tool development costs, easier

tool design and improved usability in the

future. “If OEM and tool companies could

create and utilize a ‘Generic Data Template’

(GDT) for scan tool data, then OEMs could

output their data in the GDT format so that

any toolmaker could extract and then

optimize functionality for their customers.”

Mr. Carr indicated that this kind of

collaboration and standardization could even

lead to “smart” devices (tablets, phones and

more) that could serve technicians as single

diagnostic and service platforms. Automakers

could deliver service information and

diagnostic scan tool software to technicians

— via apps, for instance — onto fewer, if

not just a single handheld tool. That the

most recent operating systems just launched

by Microsoft Corp. and Apple Computer Inc.

are both geared to mobile smart devices

further bolsters the infrastructure for this

potential future solution. “In fact, I know

of one automaker who is planning to do just

that in the very near future,” Mr. Carr

hinted.

Void of the confusion that learning how to

navigate proprietary websites and factory

scan tools creates, the potential for a

future with standardized apps, increased

technician productivity, sustained shop

profitability, and other benefits is very

possible. Imagine that, and one can envision

runaway technology being tamed in a easily

manageable fashion.

Insight #3:

Managing the future can remove the

fear of the future.

“Awareness, education and training are key

to being a successful shop in the future,”

Dave Hobbs (Delphi) cautioned. “I haven’t

seen a radical change like ‘hybridization’

since 1981 when the computer came on-board

on every vehicle.” He noted that just 15

percent of shops today are truly prepared

and ready to diagnose and work on hybrids.

“Shops and technicians are in for a really

rough ride if they don’t embrace and train

for hybridization and other inbound change

now.”

“Shop technicians also need re-flash

training and competent tooling,” Mr. Hobbs

continued. “Only 10 percent of shops I

survey use factory tools and just 5 percent

of shops own and use a J2534 re-flashing

interface tool.” As a result, many

independent aftermarket repair shops are

increasingly less productive today because

they have farmed out too many opportunities.

Making it worse — like a dinosaur sliding

downhill on ice — the refusal by these

collision and mechanical facilities to

recognize, embrace, adapt and prepare for

inbound market trends and opportunities will

seal their fate and preempt their

sustainable, profitable future.

Another looming challenge is that a

significant percentage (15 to 25 percent,

depending on the source) of the technician

population is about to retire in the next

five to 10 years,” explained Penske’s Mike

Hasinec. Other presenters echoed that

sentiment. “In addition, the younger

generation doesn’t see desirable career

opportunities and attractive incentives to

become a technician.”

With technology changing at a rapid pace,

the demand for future skill sets is shifting

from being mechanical in nature to a focus

on computer, electronic, diagnostic and

problem-solving competencies. Mr. Hasinec

suggested that the industry must cooperate

to strive for a new breed of technician by

enhancing and marketing the image of being a

technician, developing solid career paths,

requiring meaningful (not just time spent)

continuous education after hiring, moving

toward condition-based maintenance, creating

better safer and more amenable work

environments, and simplifying how technology

is applied.

Tom Kotenko (Snap-on Business Solutions)

pointed out that increasing electronic

complexity and more stringent regulation are

further complicating the heavy-duty market —

which is comprised of 50,000 fleet

maintenance, 13,000 independent and 3,000

dealerships facilities — experiences that

the light-duty market is familiar with. Idle

control, event data recorders and more

stringent emissions controls that take

effect in the 2013 model year are near-term

challenges that also create new market

opportunities for related tools and

equipment. “We’re on the cusp of

transforming the service/repair technician

base, but we need a whole new breed of

technician.”

Insight #4:

Improved service readiness is in

everyone's best interest

Improved communication and common standards

can also elevate vehicle service readiness

at aftermarket dealerships, independent

shops and other automotive businesses,

according to Mark Saxonberg (Toyota). “Let’s

define ‘Service Readiness’ as having

received the accurate service training,

service information, service tools and

service parts necessary to perform any

diagnosis, repair and/or adjustment that

might be required to support a product, in

advance of product arrival for maintenance,

diagnosis or repair.”

He then demonstrated Toyota’s “360°

Service Support” model that Toyota has

implemented. Essentially, Toyota views

itself as being in the business of selling

cars and the OE parts to fix them.

Everything else that Toyota does is meant to

support that model. With a compatible laptop

and a $55 two-day subscription, Mr.

Saxonberg showed that any automotive

facility can perform accurate diagnoses and

effect complete service or repairs — without

concern for where, when, what or who.

Mr. Saxonberg showed how improving

communication, employing open standard

J2534-interfaced diagnostics, providing

complete web-based service information via

low-cost, short-term subscriptions, and more

meaningful collaboration with Tier 1

suppliers, tool and equipment manufacturers

and the aftermarket has vastly improved

service readiness for everyone — dealer or

independent technicians. In the end, he

concluded, consumer brand experience is

maximized, which benefits everyone from

those who build cars through to those who

fix them to those who own them.

For doubters amongst other OEMs, Mr.

Saxonberg shared one more nugget. “One might

think that moving to open standards to lower

costs of OEM diagnostic tools and service

information might decrease revenue for the

automaker or tool manufacturers.” He

emphasized that the Toyota experience has

been quite the opposite. “Total revenues

from providing Web-based service information

and diagnostics through an aftermarket

J-2534 interface device have actually

increased. Aftermarket facilities are more

service-ready, technicians are able to

service and repair our vehicles and Toyota

customers keep buying our vehicles.” Bottom

line? Outstanding service support from OEMs

is profitable in more than just monetary

terms.

Insight #5:

We’re all in the same boat

Whether an independent, a dealership or

fleet facility, the angst regarding

serviceability represents shared

frustrations. Large-sized fleets may have

the muscle to get solutions, given their

size, but independent shops and dealers

share many of the same needs that, when

agglomerated, are similar in size and scope

to those of fleet networks. They just aren’t

as obvious.

“National fleet accounts need complete,

turnkey solutions from tool and equipment

providers who have a national distribution

and service presence as well as the

financial resources to support them,” Bob

Armstrong (Bridgestone Retail Operations)

asserted. “Tool and equipment solutions must

cover a large number of service outlets and

fit service for the wide range of vehicles

across a wide variety of technician

competencies. More importantly, solutions

must be easy to implement and use.

Consider Bridgestone LLC’s recent experience

regarding a tire pressure monitoring systems

(TPMS) tool purchasing decision for its

2,250 locations nationwide. “If our

facilities have to send out a vehicle for

TPMS, the dealer charges us anywhere from

$60 to $200 per.” The solution had to be

implemented uniformly and completely at

every outlet; the cost of that solution

multiplied by 2,250 locations is serious

coin. But that pales in comparison with

purchasing factory tools from each OEM for

each outlet.

Bridgestone therefore sought a generic

aftermarket solution. The company narrowed

its TPMS tool search down to three

aftermarket generic possibilities. However,

two of them involved a manual that exceeded

1,000 pages, given the wide range of

vehicles to be serviced. Bridgestone decided

to team the third technology company with an

information systems company, a partnership

that led to a compact synthesized 53-page

service booklet that its technicians could

more easily digest and use.

Here’s another example, one that involves

telematics. It always intrigues me when I

find examples of the automotive industry

catching up with the medical industry.

Following my personal experience with a

heart event and recovery at a local cardiac

rehab program, I have since learned to read

and interpret heart rhythm waveforms as a

volunteer (surprisingly similar to what

technicians do with automotive waveforms).

I’ve also learned much about cutting-edge

telematic and imaging technology used today

with cardiac patients.

LifeWatch Corp., for example, manufacturers

a wireless telematic heart monitor that

continuously monitors heart function 24/7.

It automatically detects intermittent or

regular problems and then sends relevant

data to a centralized monitoring call center

where certified cardiac technicians

interpret the data, make authorized fix

where possible and notifies physicians and

patients. This monitor, about the size of a

small cell phone, requires only minimal

patient intervention, significantly

increases diagnostic yield and leads to more

appropriate and certain therapy.

Let’s consider a similar application of this

concept to our industry. While some OEMs

have a diagnostic service like General

Motors Corp.’s On-Star telematic diagnostic

system, most don’t. Individual aftermarket

service/repair facilities definitely don’t.

Until now.

At ToolTech 2011, Carma Systems Inc.

demonstrated a prototype of its new

automotive wireless telematic monitor. The

palm-sized Carma device — which incorporates

a built-in GSM chip and processor — plugs

into the vehicle’s under-dash OBD II port,

then works on an exception-based

methodology, much like the LifeWatch heart

monitor. When an exception is found,

notification is sent to a centralized

information management provider who then

notifies the customer’s shop, so that an

automotive technician can contact the

customer to correct the problem when

possible, or advise the customer to make an

appointment. The company expects the device

to be available in the fourth quarter of

2011, at a price of approximately $120. Is

that a future you can grab hold of?

One last thing

Getting back to the standardization and

service readiness insights for a moment,

just think of the time and money that could

be saved, and better used elsewhere, if the

aftermarket and OEMs collaborated to develop

common solutions for diagnostic, telematic

and other futuristic capabilities. Our

ingrained past practices and archaic

mindsets often act to curb our progress to a

better future. Our rush to preserve legacy

solutions and thinking, let alone protect

any and everything we might consider

proprietary in nature and value, makes it

tougher than it has to be. After all, there

is risk in becoming stagnant.

It’s time to shed the ball and chain by

deciding what kind of future we really want

and then moving towards it, even if we have

to set aside some of our past. Events such

as ToolTech push us challenge our

preconceptions and entrenched positions.

Being able to rethink vehicle serviceability

today to better empower the shop of tomorrow

illustrates that our industry can change for

the good going forward. It’s really just a

matter of choice.

|

Are

You Ready For The Future?

The

vehicle electronic revolution is now a

reality that, like a compass, point

the way towards new business

opportunities for tool and equipment

manufacturers. Click on the image to

watch this seven-minute video to see

which trends are driving the future of

aftermarket service/repair and

collision facilities. (Video — Delphi

Corp)

Navigating

the Scan Tool Maze

John Jenkins, an automotive consultant and

founder of C.A.S. of New England, helps

aftermarket facilities make better-informed

scan tool purchase decisions. Jenkins

defines four types of scan tools. If buyers

knew which of the four broad categories

before buying a tool, the functional reality

of the tool would better fit their

expectations. Here are his

definitions:

- OEM (Factory) scan tools are the

current scan tools used in automakers’

franchised dealer service departments

(e.g. Ford IDS).

- Specialty scan tools focus on

particular car line (e.g. Ross-Tech VCDS

VW/Audi scan tool).

- Aftermarket scan tools are those scan

tool built for industry use that are not

a recognized OEM scan tool.

- OEM-level scan tools include any tool

that an aftermarket scan tool

manufacturer wishes to term as such.

It’s a marketing term.

Opportunity

Knocks: The Collision Sector

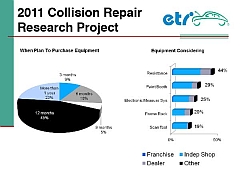

According to the findings of the recent 2001

ETI Collision Repair Research Project, the

top five growth opportunities for tool and

equipment providers in the collision sector,

based on collision facility purchase

intentions over the next 12 months, are

resistance welding equipment, paint booths,

electronic measuring systems, structural

frame racks, and diagnostic scan

tools. (Image — ETI Collision Group)

Opportunity

Knocks: Mechanical

Delphi's

Multimode Electronically Scanning

Radar's compact packaging and

innovative technology are helping make

radar-based safety and convenience

systems more affordable in the

high-volume automotive market.

According to Delphi Corp. industry research,

the mechanical service/repair sector has

undergone a major shift, driven by

computerization, electrification,

alternative power-trains and safety.

Emerging opportunities for tool and

equipment providers include reprogramming

and re-flashing, as well as diesel, hybrid

and fuel cell technologies — many of which

didn’t exist 15 years ago. More are on their

way. (Image — Delphi Corp.)

Raise

the Service Readiness Bar

|

From

Toyota's TIS Website.

The

University of Toyota,

Technical and Body Service

Training Development

Department creates a variety

of instructional materials

used to develop the skills

and abilities of Toyota and

Lexus Technicians. Although

developed for use in our

comprehensive technician

training curriculum, the

following valuable technical

training materials are

available on-line in the TIS

library.

- New Model

e-Learning Modules

- Current

Core Training e-Learning

Modules

- Technician

Handbooks

- Toyota

Tech Online Magazine

For

additional training

opportunities, Toyota offers an

outstanding technician

development program for

individuals interested in an

automotive service career. For

more information on the Toyota

specific training accessible

through the Toyota Technical

Education Network (T-TEN) please

follow the link below. |

The shops and technicians that will thrive

in the future will invest in

"job-appropriate" service/repair resources —

information, tools and technical training —

to be fully service ready at an affordable

cost. (Text - Toyota Motors USA Inc.)

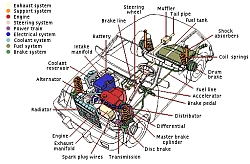

Are

You Ready for the Cars of Tomorrow?

Just

think about how computerization,

electrification, multiplexing, safety and

other technological forces have changed the

thinking, techniques and tooling employed to

service or repair five year old cars, brand

new cars today and the cars we will see five

years from now. Time won’t stand still;

neither can the aftermarket. Just

think about how computerization,

electrification, multiplexing, safety and

other technological forces have changed the

thinking, techniques and tooling employed to

service or repair five year old cars, brand

new cars today and the cars we will see five

years from now. Time won’t stand still;

neither can the aftermarket.

24/7

OBD II Telematics for the Aftermarket

Carma Systems Inc.’s wireless OBD II

monitoring device is designed to be a

customer retention tool for aftermarket

service/repair facilities. It was first

demonstrated at AAPEX 2011, as part of the

iShop, the Automotive Aftermarket Industry

Association’s (AAIA) “Shop of Tomorrow”

initiative.

|