By Bob Chabot, Contributing Editor Common GroundSummer Tech Week is authentic collaboration you can build new business aroundSometimes you just have to be there. This is especially so when to be able attend an automotive industry event, you are required to sign a nondisclosure agreement regarding the proprietary data and information that is going to be shared. Such is the case with such as 2011 Summer Tech Week (STW), one of three core events that the Equipment and Tool Institute (ETI) hosts throughout the calendar year. As a first time STW attendee, I had no grounded concept of what to expect. But when all was said and done, I was blown away by the depth and diversity of what I had learned. I just can’t tell anybody about it. Yet. STW is unique in offering ETI members the opportunity to dialogue with the Detroit- and European-based automakers. It is the only industry event where the each original equipment manufacturer (OEM) involved provides attendees with the necessary information, data streams and algorithms regarding their inbound new model year vehicles as well as updates for previous model years. By showcasing new vehicles and associated technologies, the industry can then discuss and develop the needed tools, equipment and service/repair procedures that these new vehicles may require.

Attendees at STW can choose from several information paths, which include the scan tool, under hood, under car and collision repair groups, around which each automaker tailors presentations. As a newbie, I chose to attend a mix of the sessions for the four groups and was welcomed warmly by whatever party I lingered with. In addition to the different tracks, each group held its own ETI vertical group meeting during STW. There’s so much I could tell you, but I am not allowed to do that. In one sense, that makes writing this article difficult. But in another way, the nondisclosure tenet frees me to do something that may well bring you, as a reader, more value, namely:

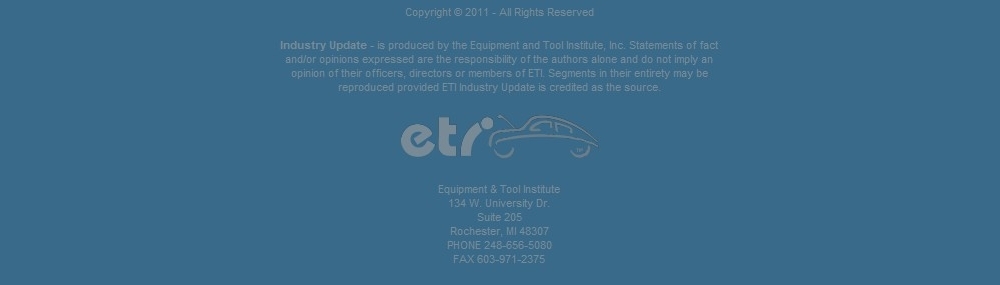

ETI doesn’t just talk and promote collaboration between OEMs and the aftermarket. It breathes, acts and delivers it. Please understand that I don’t make this observation lightly. You see, I regularly attend gatherings of the Society of Automotive Engineers and am actively involved with the National Automotive Service Task Force — both organizations that foster and make the industry better via collaboration. But ETI — through events like STW, WTW and ToolTech — distinguishes itself in ensuring that so much new tool, equipment, service and repair knowledge is willingly shared, discussed and disseminated, so that the aftermarket is ready in time. In addition, the level of respect between the OEMs and ETI’s tool and equipment membership is ever-present; it is strong enough that one can feel and savor it. Let me put this another way: ETI closes many service, tool and training gaps before the rest of the aftermarket even knows they exist. Moreover, ETI trail-blazes the path for SAE, NASTF and aftermarket trade associations. Its members eyeball, touch and begin preparing long before other organizations even see these new vehicles. Granted, this is my impression as a first-timer attendee, but it has stayed with me since the event. For instance, several OEMs at STW who have, or are launching, all-electric vehicles indicated that they are currently leaning towards wholesale replacement of high-voltage components rather than the replacement and repair of the separate parts that comprise those components. The OEMs also shared that wholesale component replacement would likely evolve to larger sections of components being replaceable, rather than entire units. Eventually, this will morph to the replacement and repair of individual parts of those components. Knowing this, and the timing of change is critical for everyone downstream of the OEMs. It not only impacts tool and equipment development, but also the timing of equipment and tools purchases by repair facilities and even the nature of related training for service professionals. In addition, regular attendance at core ETI events will apprise the industry should the pace of change quicken or move in a new direction. So what does this mean for you as an ETI member? Two things — the first indirect, the other direct. I write extensively for many of your aftermarket customers, both on the mechanical service side and the collision repair side. I can assure you that this impression will be shared with those who grace my words with their eyes. More directly, I feel compelled to make a case for ETI members when it comes to service and repair professionals considering tool and equipment purchase decisions from aftermarket manufacturers. Being an ETI member has currency; it helps service and repair professionals maintain competency. If I owned an automotive service or repair facility, or was a technician making a difference within one, I would want and need tools and equipment that are based on the latest and most accurate information available. Anything less would be a disservice to vehicle owners. My recommendation to professionals will be to check and ensure that their tool and equipment suppliers attend ETI events. If they don’t, why do business with them? It’s more than sorting wheat from chaff; it’s a matter of dollars and sense.

“Authenticity” was a word that popped up a few times in conversations during breaks at two different automaker presentations to the collision group. These conversations centered on OE versus aftermarket parts and on providing complete, “fully” safe repairs. One spontaneous conversation occurred at the end of a session that included all ETI subgroups, just before we broke out for separate presentations. A few of us began sharing experiences centered on a current collision repair practice that stipulates the use of some salvage or or otherwise substandard (certainly untested, let alone uncertified) replacement parts, a practice often driven by cost-driven insurance companies or sadly, unscrupulous collision repair facilities. As I listened, I felt like this group was talking to me — for I am a member of the car-buying public. While understanding the reasons to keep collision repair costs down, the group basically reached the consensus that consumers buy a vehicle that has certain known safety ratings. Should that vehicle be damaged in an accident, a consumer has reasonable expectations that the vehicle to be returned to its original safety ratings. When it comes to assuring a complete, fully safe repair, our industry is quick to push for proper collision repair techniques (e.g. how to weld ultra high strength steels), yet somehow we tolerate and are collectively mute about using salvage or weaker (cheaper) parts for repair, rather than either the OE parts that earned the safety ratings or their aftermarket equivalents. As a group sharing thoughts, we wondered why does authenticity apply to all repair techniques, but not to all parts used for a repair? Moreover, are we truly serving the public with practices that allow this? This dialogue left an impression left on me: As a consumer, I want authenticity; as an industry member, I am ashamed that we don’t always deliver it. The chasm between is opportunity knocking. That evening, a group of nearly 10 of us resumed the discussion about OE versus aftermarket replacement parts that had begun earlier in the day, but expanded it to include both collision and mechanical repair. We agreed that the time, money and effort expended by the OE and aftermarket protagonists ultimately obscured and prevented an authentic solution be reached. In our collective view, the authentic solution would be to develop valid standards and independent third-party testing to ensure that all replacement parts offered for sale — whether OE or aftermarket in its origin — meet those minimum standards, from a safety and automaker warranty perspective. Afterwards, several folks informed me that this discussion and resolution would not likely have occurred at any other venue than an ETI event. Therein is another lesson from STW: The germ of a solution is easily planted and can grow when we all share — without agenda to serve, separate corporate cultures to entrench or castles and moats to guard. I can buy that.

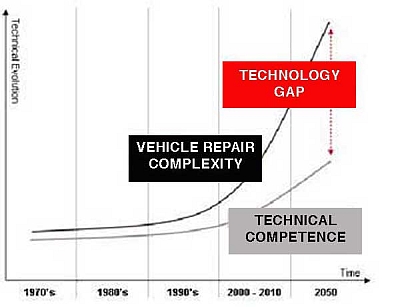

I thought I knew a fair bit about scan tools, at least in my world. But with each ETI event that I attend, I have breathed humility and seen my ignorance. While I had heard about scan tool information files, what I knew of them was rather vague and nebulous. At STW, my eyes were opened to a whole new dimension. “There are three layers or categories of information that scan tool manufacturers need in order to develop their software,” ETI Executive Manager Charlie Gorman shared with me. Just as an iceberg isn’t visible to the casual observer and widens with depth, when looking at a file of scan tool information, Gorman noted that each of the three successive layers in the hierarchy below is more detailed and complex. He also explained that data provided by OEMs at meetings like STW is then stored by ETI in its TEK-NET library, where it is made available to members. These information layers include:

In simple terms, this increasing scale of scan tool information complexity is like blowing up a map when necessary by those who need to know more. The overview shared by Gorman and the information provided during scan tool group sessions at STW provided me with a much deeper appreciation of the complexities that tool and equipment makers deal with every day. Many in my world, who use your tools, take this detail granted or aren’t even aware of it and the pitfalls that can be present. That’s worth sharing, as is dealing with tool and equipment manufacturers who are actively working with automakers to improve vehicle serviceability. While networking after a scan tool group session with an OEM, I sat down with three scan tool manufacturing company principals. I will not identify here, but will share some of their insights. “Content is king,” one of them asserted. “It’s all about getting the information at sessions like today’s and putting as much of that new functionality into scan tools as possible while meeting certain market pricing points. The value of an event like STW is that we get to know what we need to know early and also ask about what we know we don’t know.” The conversation then evolved into what type of scan tools aftermarket users preferred — handheld or PC-based. For me it was interesting to watch these competitors banter the pros and cons of each — largely based on what form their own scan tools took. But here’s what intrigued me: Each principal acknowledged that the type of tool platform didn’t really matter, content and functionality did. And if anything, the only relevant driver for the type of scan tool platform should be what the end-users — technicians — wanted. Given recent technological breakthroughs, such as cloud computing, tablets, etc., I then ventured to ask them about the possibility of automotive technicians one day being able to own just one “smart” device as a scan tool platform that was capable of receiving and implementing scan tool functionality delivered wirelessly as an app from any or all aftermarket scan tool companies and/or automakers.

Here’s the rub: ETI’s Summer Tech Week is part of the cure that our industry needs. I suspect that I am pretty typical of those technician and shop customers that you all deal with. We use tools and equipment that you build. Yet together, you, the OEMs and service/repair professionals collaborate to enable the improved servicing of vehicles that the public buys. That ongoing dialogue is allowing us to build a common perspective that helps us all become more efficient and effective. That is a win-win scenario for everyone. |